The Fed Is Getting More Hopeful It Can Avoid a US Recession

By Craig Torres and Rich Miller

September 8, 2023 at 8:33 AM PDT

Federal Reserve officials are increasingly optimistic they can quash inflation without causing serious economic pain.

Encouraged by signs that price pressures and the labor market are gradually cooling, Fed officials are intent on not squandering their chance at an elusive “soft landing” by raising interest rates too much, even as they remain committed to returning inflation to their 2% goal. With that in mind, policymakers are preparing to hold rates steady at their Sept. 19-20 gathering, and may lift them once more if needed this year, amid a spate of strong economic data.

The balancing act is critical to the legacy of Chair Jerome Powell: Restoring price stability after a large inflation shock without a recession would be a rare achievement in modern policymaking, and perhaps temper criticism that he reacted too late to rising prices.

“Maybe the soft landing is really possible,” said Ellen Meade, a former senior adviser to the Fed board and a research professor at Duke University.

“They don’t want to communicate their excitement because financial markets will undo all they have done,” she added.

Having been burned several times by false dawns of disinflation, policymakers are wary of declaring a premature end to their credit-tightening campaign and are likely to retain a bias toward higher rates for some time.

The policy-setting Federal Open Market Committee has raised its benchmark federal funds rate 11 times since March 2022 to a range of 5.25% to 5.5%, the highest level in 22 years. Officials including Powell have emphasized that, as they near the end of their aggressive rate-hike cycle, they’ll proceed carefully and rely on the data to determine whether further increases are needed.

That puts the burden on incoming data to convince officials to lift rates beyond the restrictive level they’ve already achieved.

“We’ve gotten monetary policy in a very good place,” New York Fed President John Williams said Thursday at an event at Bloomberg LP’s headquarters in New York.

Reports in recent weeks have offered reassurance that the inflation fever is breaking.

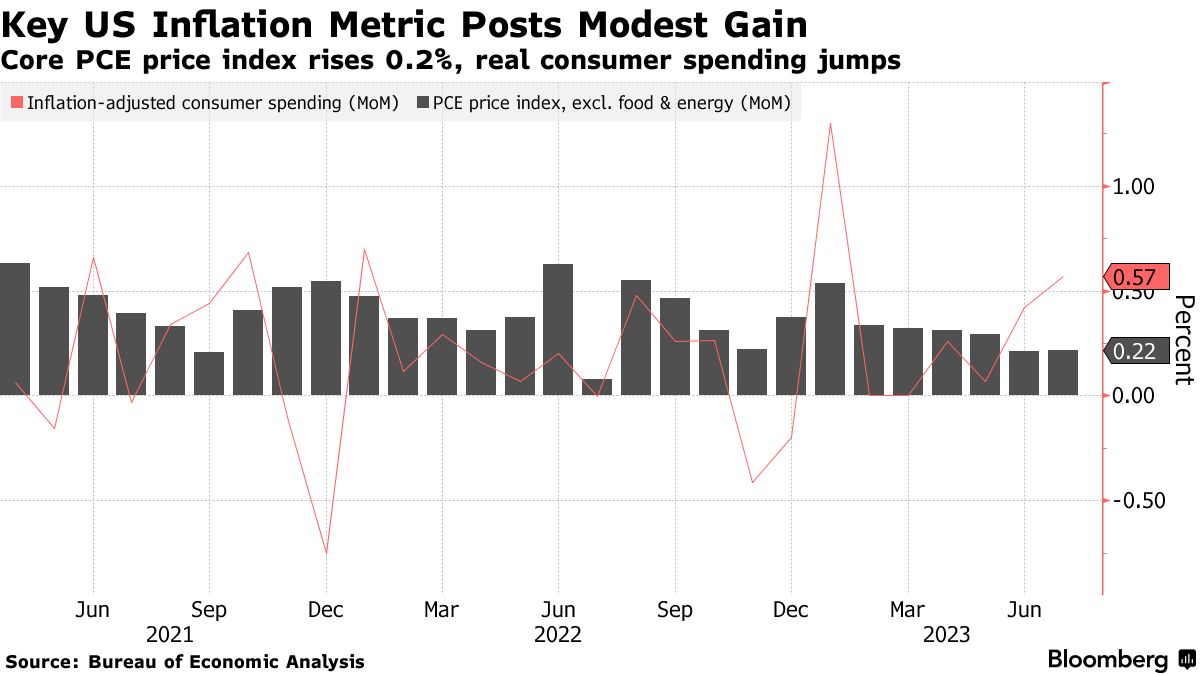

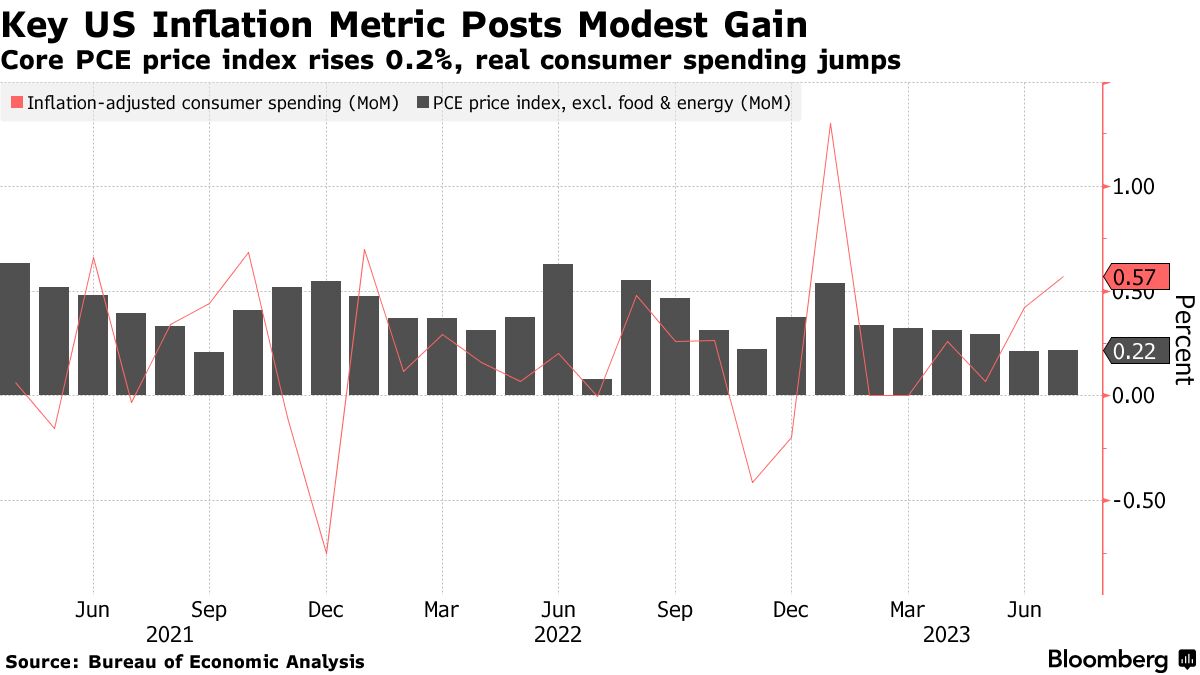

The Fed’s preferred measure of underlying price pressures posted the smallest back-to-back increases since late 2020, a Bureau of Economic Analysis report showed last week. The core personal consumption expenditures price index rose 0.2% in June and July, down from an average of nearly 0.4% in the first five months of the year.

A separate Labor Department report last week showed job gains for June and July were weaker than previously reported, the jobless rate climbed and wage growth slowed, further signs of the labor-market cooling that Fed officials have been looking for.

Fed Governor Christopher Waller, one of the central bank’s most outspoken advocates for tighter policy, called it “a hell of a good week of data.”

“There is nothing that is saying we need to do anything imminent anytime soon,” Waller said in an interview on CNBC Tuesday, signaling he supports keeping rates on hold at the central bank’s next meeting. “We can just sit there and wait for the data.”

Officials will see one more key inflation reading before their September gathering when fresh consumer price data for August is released on Wednesday.

With low confidence in forecasts, inflation too high and the risk that overall growth continues above trend, policy hawks like Waller and Dallas Fed President Lorie Logan, as well as centrists such as Boston Fed President Susan Collins, are keeping a hike later this year on the table.

Still, Logan has sounded a more balanced note, saying policymakers “must proceed gradually.”

“The FOMC cannot safely throw bucket after bucket of cold water on the economy just in case inflation catches fire again,” she said Thursday at an event in Dallas. “If we did that, not only inflation but economic activity itself would soon be ‘cold out’ — which is not an outcome we want.”

Investors expect Fed officials will skip a rate increase this month, but see roughly even odds of another 25 basis-point hike at the Oct. 31-Nov. 1 meeting.

Policymakers will submit updated economic forecasts at their September meeting that will likely show broad agreement for one more rate increase this year.

‘Dramatic Slowdown’

For the soft landing to come together, Fed officials have said they need to see further slowing in the labor market and in overall demand.

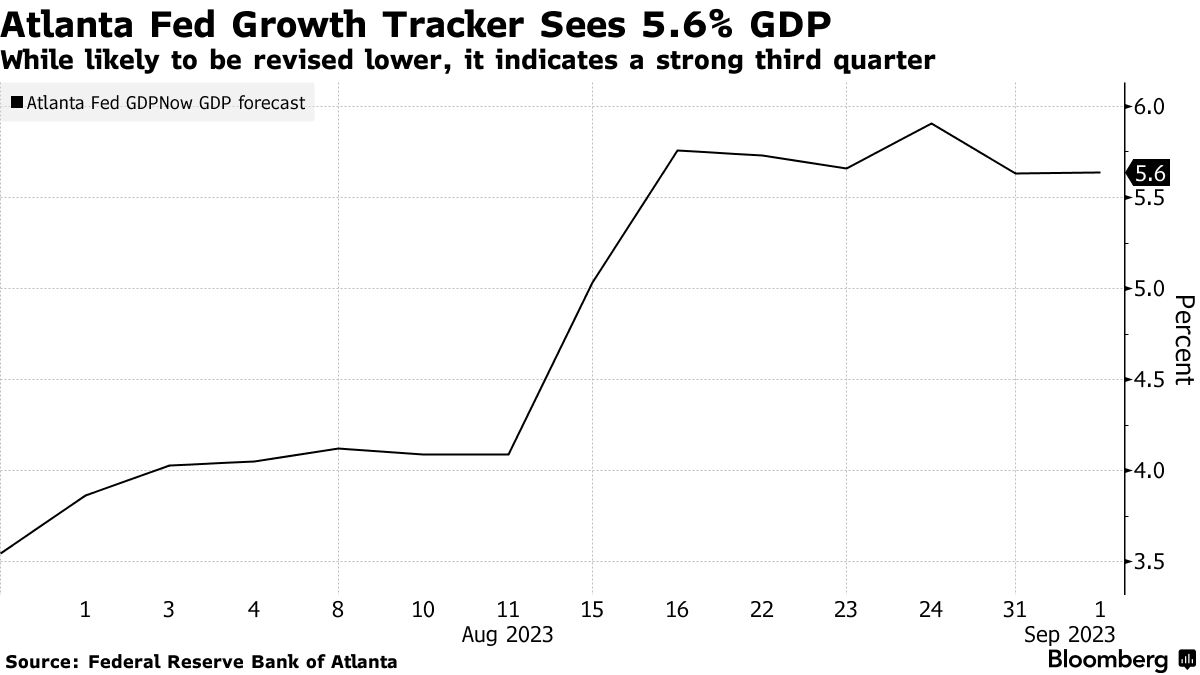

Economists have been boosting their forecasts for quarterly gross domestic product following a string of stronger-than-expected reports, including consumer spending and residential investment.

Decelerations in Europe and China may provide a disinflation tailwind for Fed policy over the coming months.

“It cements in place a more favorable profile for goods inflation,” Michael Feroli, chief US economist for JPMorgan Chase & Co., said of China’s slowing economy.

Forecasts for US growth also suggest a step-down in output in the final three months.

Jonathan Millar, senior economist at Barclays Plc, said spending that was pulled forward into the current quarter will detract from the final three-month period, as will the resumption of student loan payments and tighter credit as Fed rate hikes continue to bite.

“We show a dramatic slowdown,” Millar said, with growth dropping to a 0.5% annualized pace from October through December. Even so, “we have been surprised again and again by just how strong GDP growth has been.”

That is in essence the Fed’s challenge. It has low confidence in its own forecasts, and with inflation still too high the option to tighten further has to be kept in place. Further restraint could snatch away the soft landing, which historically is “pretty rare,” Millar said.

When wrestling down inflation, Millar said, “the Fed tends to overtighten” right into a recession. That’s a mistake that officials are determined to avoid this time around.

Link to original article: The Fed Is Getting More Hopeful It Can Avoid a US Recession